If you are an entrepreneur from an EU country, you have the opportunity to purchase goods from our store without VAT.

To make VAT-free purchases, you must meet the following conditions:

- Have an active EU VAT number (TIN) listed in the VIES database.

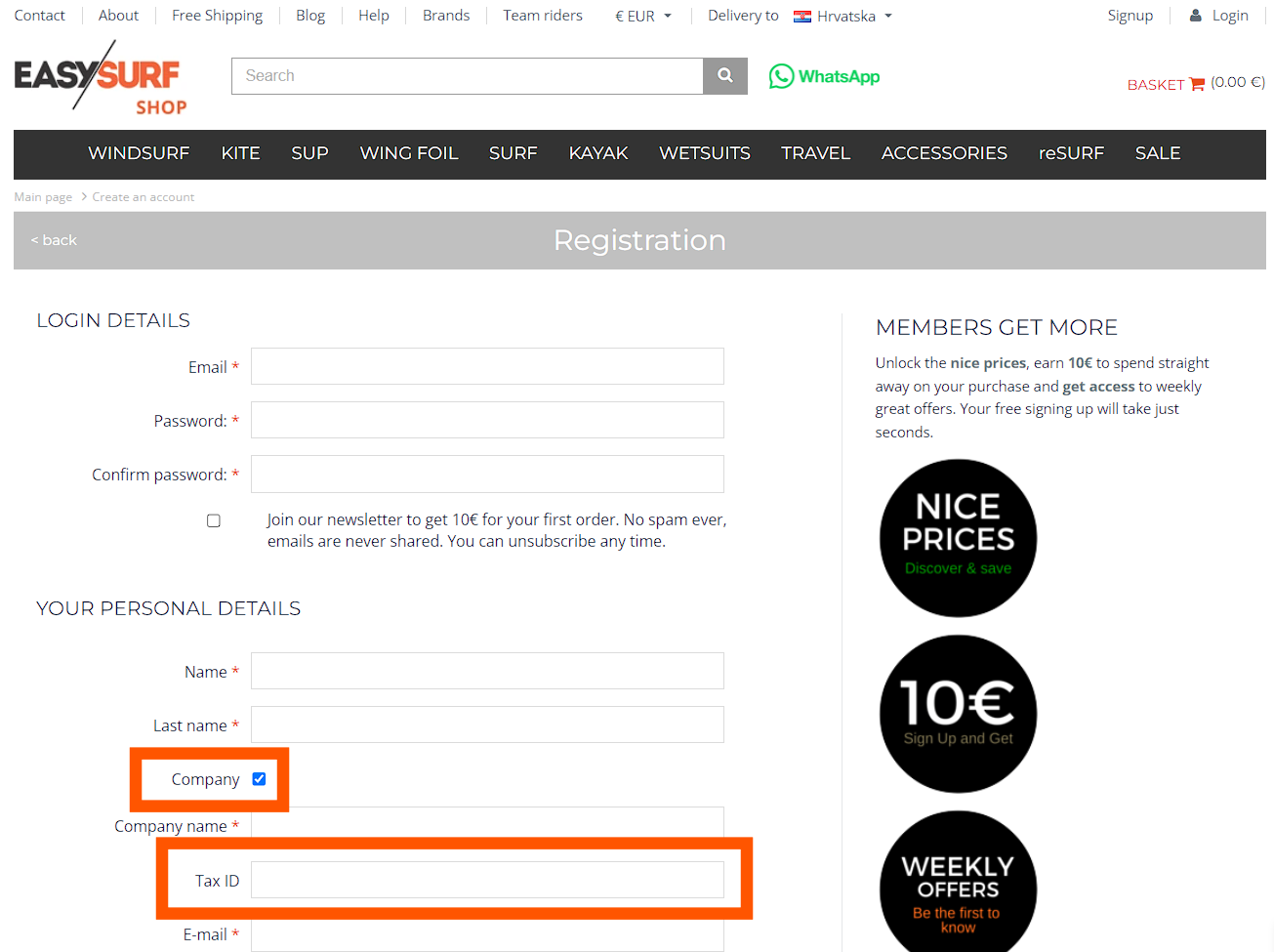

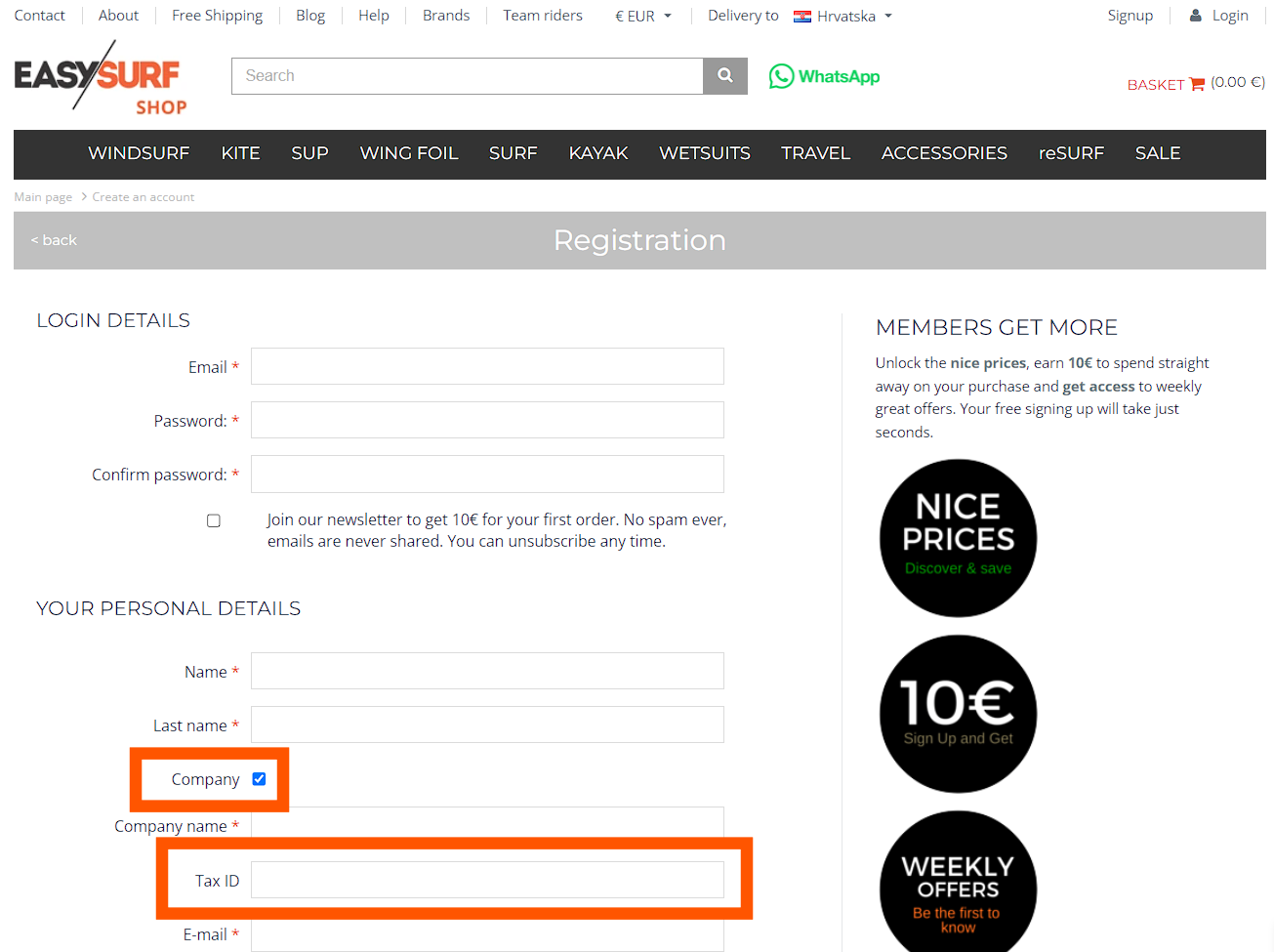

- Create an account in our store for your company by selecting the Company option in the registration form and filling in the TAX ID (TIN) that is active in VIES database.

- After creating and logging into your company account, you will see net prices (excluding VAT).

- Proceed to place your order as usual.

- Our customer service department will verify your order and check if the provided TAX ID (TIN) is active in the VIES database. If the provided TAX ID is not active in the VIES database, you will be asked to update it or pay the VAT applicable to your delivery country.

If you wish to make private purchases, you must create a separate, non-business account. For private purchases, you will be required to pay VAT.

Blog

Read

Bigger days, smoother shopping: 2025 at EASY-surfshop! Event highlights, new brands and the improvements behind the scenes.

READ MOREWatch ▶️

Maciek Rutkowski shredding Australian waves!

Maciek Rutkowski swaps racing gear for his wave setup in Australia. Nice conditions, clean lines and wave riding! Pure windsurfing fun!

READ MOREWatch ▶️

King of the Bay 2025 – Aftermovie!

Garnier King of the Bay 2025 didn't dissapoint. So sit back and enjoy this official aftermovie!

READ MORE

Facebook

Facebook Instagram

Instagram YouTube

YouTube